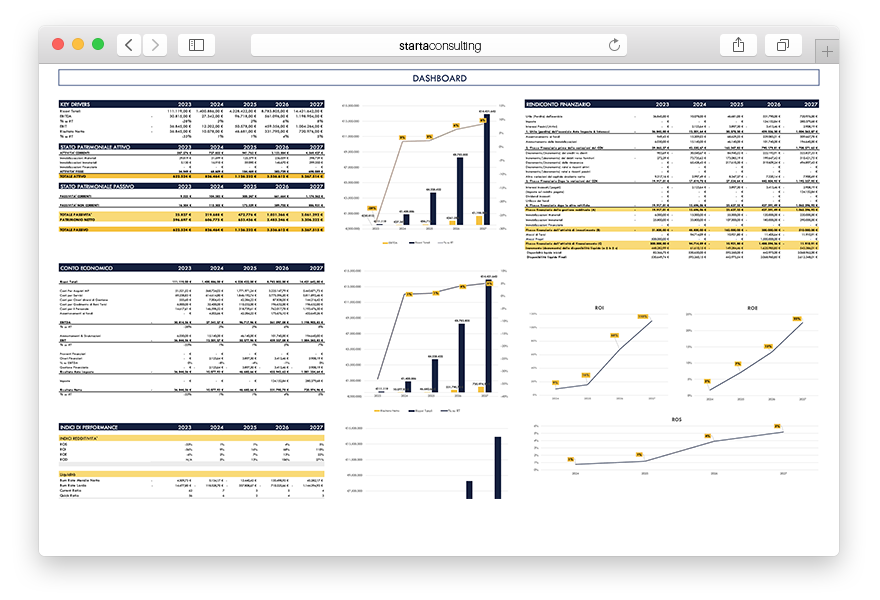

Whether in startup or scale-up phase, building a robust financial plan is essential for understanding the current and future financial, income, and asset structure of a business, identifying growth opportunities and strategically planning the required resources to achieve your KPI objectives.

Financial Plan

Our team specializes in creating customized Financial Plans to present to stakeholders such as investors, financial institutions, and industrial partners.

We build financial plans that, assessing the evolution of costs and revenues in alignment with business model and milestones, allow the company to:

- Analyze growth projections and planning strategic development employing financial sustainability and cost coverage analyses to mitigate business risk.

- Streamline access to bank credit by conducting a sustainability analysis of the debt repayment plan.

- Structure extraordinary finance operations using predictive analyses based on business evolution dynamics.

Discover our Financial Plan modules

- Revenue Analysis and Forecasting

- Fixed and Variable Costs Analysis and Forecasting

- CAPEX Analysis and Forecasting

- Ratio and Margin Analysis and Forecasting

- Income Statement Analysis and Forecasting

- Balance Sheet Analysis and Forecasting

- Cash Flow Statement Analysis and Forecasting

- Profit & Loss Statement Analysis and Forecasting

- Sensitivity Analysis

- Debt Analysis and Forecasting

Valuation

Our team is specialized in extraordinary finance operations, encompassing mergers, acquisitions, contributions, capital increases, and stock option plans.

We identify and apply the most suitable valuation methods based on company’s features and objectives. Our approach goes beyond accounting value, taking into account discounted future value.

Whether you are a startup seeking capital or a scale-up aiming to accelerate its growth, valuation is crucial for estimating the company’s value and planning the onboarding of new investors.

Valuation Methods applied

- Discounted Cash Flow (DCF)

- Asset-based Method

- Multiple Method

- Venture Capital Method

- Berkus Method

Advantages

- Evaluate the sustainability of a business model or a new business unit

- Analyze business sustainability through stress tests

- Manage current and future cash flows efficiently

- Evaluate investments and hedging instruments

- Identify target margins on revenue lines

- Improve financial and tax planning

- Mitigate business risk

Fractional CFO

Monitor financial performance and improve corporate profitability.

Fundraising Planning

Prepare for the next round and accelerate the growth of your business.